The Economy of Uzbekistan-Mongolia

According to the Asian Development Bank, Mongolia maintained econMongolia bility in 2024, with GDP growing by 4.9% and reaching $21.3 billion. The largest share of Mongolia’s GDP structure is occupied by services (46.8%), followed by mining and quarrying (25.2%), agriculture (13%), and other sectors (15%).

Mongolia possesses significant mineral resources, with over 8,000 known deposits and approximately 1,200 mines extracting more than 80 types of minerals. The country has vast reserves of coal (33.4 trillion tonnes), iron ore (1.84 trillion tonnes), oil (332 million tonnes), copper (69.9 million tonnes), uranium (192 thousand tonnes), and gold (448.1 tonnes).

It is noted that 70% of all foreign investment is directed toward the mining sector, while the remaining 30% is distributed across trade, food production, banking and financial services, and other industries. Key industrial outputs include coal, processed milk, cement, electricity, copper, flour, rolled metal, and gold.

Livestock Breeding and Cashmere Production

Agriculture in Mongolia is predominantly based on livestock breeding. The country ranks among global leaders in the number of small and large ruminants, especially cashmere goats and sheep. In 2024, the total livestock population reached 67 million head. Raw cashmere production exceeded 10,000 tonnes, accounting for around 40% of global output. However, less than half, approximately 4,500 tonnes, is currently processed domestically. The processing sector employs around 10,000 people, about 90% of whom are women. By 2028, the government aims to achieve 100% primary processing and 40% deep processing of raw cashmere within the country

Mic activity in 2024 showed positive dynamics, with total trade turnover reaching $27.4 billion – an increase of 12.3% compared to the previous year. Exports amounted to $15.75 billion, while imports totaled $11.65 billion, resulting in a trade surplus of $4.1 billion. The country’s export structure is heavily dominated by mining products, which accounted for roughly 90% of total exports.

Major export items included coal ($8.43 billion or 53.5%), copper concentrate ($2.65 billion or 16.8%), gold ($835 million or 5.3%), iron ore ($365 million), and textiles ($356 million). The main export destinations were China, Switzerland, Singapore, South Korea, and Russia.

Imports were led by petroleum products ($2.15 billion or 18.6%), passenger vehicles ($1.1 billion), trucks ($742.7 million), construction machinery ($522.3 million), telecommunications equipment ($282.5 million), as well as a broad range of other goods amounting to $6.8 billion. The primary import partners were China, Russia, Japan, South Korea, and the United States.

Investments from the European Bank for Reconstruction and Development (EBRD) in Mongolia reached €264 million in 2024, compared to €143 million in 2023. The cumulative volume of EBRD investment in Mongolia has reached €2.6 billion, of which 74% is directed toward the private sector.

Trade Turnover Between Uzbekistan and Mongolia

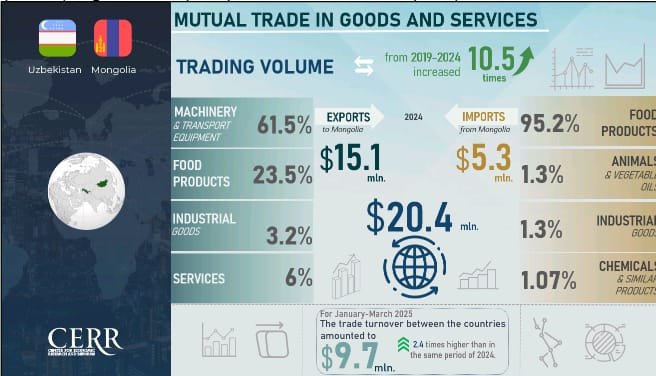

Between 2019 and 2024, trade turnover between Uzbekistan and Mongolia increased more than 10.5-fold, rising from $1.9 million to $20.4 million. During this period, Uzbekistan’s exports grew from $1.5 million to $15.1 million, while imports increased from $519,000 to $5.31 million. In 2024 alone, bilateral trade turnover rose by 46.8%, with both exports and imports expanding by 47%.

In the structure of Uzbekistan’s exports to Mongolia, the largest share is held by machinery and transport equipment, totaling $9.3 million (61.5%), followed by food products worth $3.55 million (23.5%). Other export categories include services, industrial goods, finished products, beverages, and tobacco. Imports from Mongolia are dominated by food products, which accounted for $5.06 million (95.2%), in addition to smaller volumes of oils, industrial materials, and chemical products.

In the Q1 2025, trade turnover between the two countries reached $9.7 million, which is 2.4 times higher than the figure for the same period in 2024. However, during this period, exports from Uzbekistan declined by 33.1%, while imports grew 10.5-fold due to increased supplies of machinery and transport equipment ($4.9 million), as well as food products ($2.4 million).

Prospects for Further Cooperation

Both sides have ample opportunities to deepen their bilateral cooperation. First, there is significant potential for expanding exports of Uzbek products to the Mongolian market, particularly in categories where Uzbekistan enjoys sustainable competitive advantages.

Second, one of the most promising directions is the establishment of joint Uzbek-Mongolian ventures in Mongolia focused on processing wool and leather, as well as manufacturing textile products. A particularly relevant initiative could be the development of facilities for the deep processing of cashmere, including spinning, dyeing, and the production of knitwear and garments, involving Uzbek expertise and technological know-how.

Cooperation in the cashmere sector could be elevated to a qualitatively new level through the creation of joint processing capacities, experience-sharing, workforce training, and the development of export partnerships. This would strengthen both countries’ positions in the global value chain for high-value-added natural textiles.

Third, there is clear interest in the involvement of Uzbek companies in the processing of Mongolia’s copper and gold-bearing ores. Such cooperation could involve outsourcing refining operations to production facilities in Uzbekistan or the creation of a joint venture on Mongolian territory. The latter could specialize in the metallurgical processing of concentrates and ore, including the production of cathode copper, refined gold, and other high-value-added products.

The implementation of these projects would not only enhance industrial cooperation between the two countries but also help reduce Mongolia’s dependence on raw commodity exports while expanding the global reach of jointly produced goods.