“Trump’s second-term tariffs spark a new U.S., India trade war, straining exports, trust, and the future of the Indo-Pacific partnership.”

Tariffs are often sold as a show of strength, a way of defending national interests in an unfair world. In reality, they are the bluntest of instruments, creating far more friction than efficiency. And when tariffs move from being an economic tool to a geopolitical weapon, the collateral damage multiplies.

That’s exactly what we are seeing in the latest round of U.S. tariffs on India measures that reach far beyond trade balances and touch the very foundations of the India-U.S. strategic partnership.

As Donald Trump begins his second term as U.S. president, the world once again finds itself pulled into a contest of economic brinkmanship that looks less like technical policy and more like a tug of war. Imagine a rope stretched taut between nations, each pulling harder, not to advance but to exhaust and injure the other. The damage will not be confined to capitals or boardrooms but will ripple across households, factories, and farms worldwide.

The Return of Tariff Trump

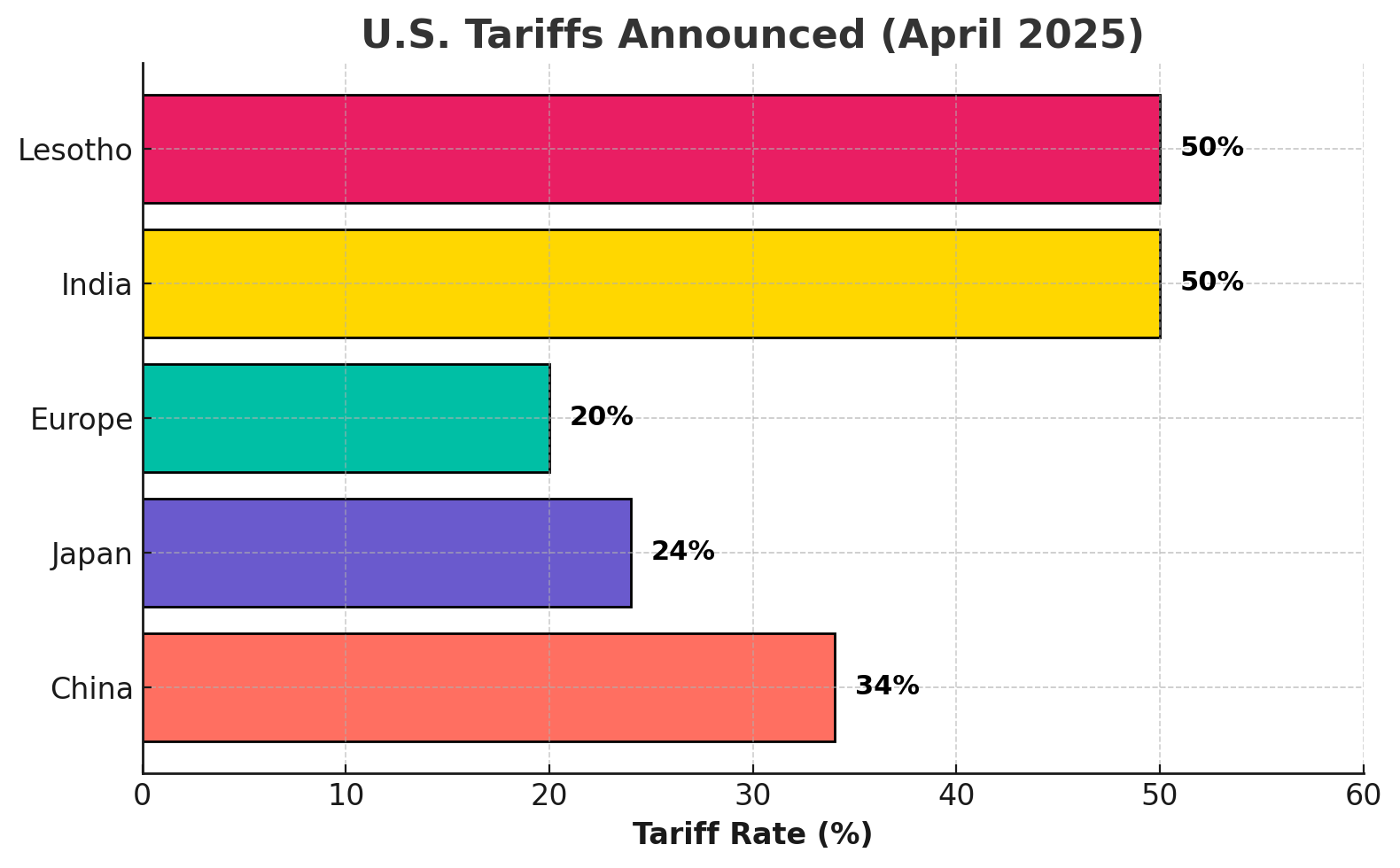

The opening act of this new trade war was not subtle. On April 2, 2025, just weeks after taking office, Trump signed an executive order announcing a sweeping “Declaration of Economic Independence.” The order imposed a baseline 10% tariff on nearly all imports, with “reciprocal” duties far higher on specific partners:

34% in China

24% in Japan

20% in Europe

50% in India

50% in Lesotho, a small African nation with a negligible trade footprint.

The arbitrariness was almost as startling as the ambition. For Trump, tariffs are not tailored scalpels but blunt hammers, dramatic statements that speak to his political base as much as to foreign negotiators.

The precedent is not encouraging. During his first term, a 2019 Moody’s report estimated tariffs cost the U.S. about 300,000 jobs and shaved 0.3% off GDP growth. Columbia University research found that American companies lost nearly $1.7 trillion in market value due to tariff-related uncertainty. Then, as now, the short-term optics of toughness concealed long-term costs.

China: The Perpetual Rival

The fiercest tug on the rope is between Washington and Beijing. In late 2024, the U.S. had already finalized tariff hikes on Chinese solar components, raising duties to 50% starting in December. By early 2025, those measures expanded across multiple industries, and Beijing retaliated with higher levies on American agricultural exports.

Together, the U.S. and China account for 43% of the global economy and trade more than $585 billion annually. Disruptions to that flow ripple outward to Europe, Africa, Latin America, and Southeast Asia, dragging fragile economies into inflation and recession.

India in the Crosshairs

This is not just a U.S.-China duel. India has become a prime target of Washington’s tariff barrage. Officially, U.S. officials claim the tariffs are “reciprocal,” meant to correct India’s own trade barriers. But the political timing tells another story. They coincided with India’s continued purchases of discounted Russian oil, a sore point for Washington as it seeks to isolate Moscow.

On August 6, 2025, Trump signed another order, doubling tariffs on Indian imports to 50%, explicitly citing New Delhi’s energy ties with Moscow. The tariffs officially took effect on August 27, 28, 2025, hitting nearly $86.5 billion worth of Indian exports to the U.S. annually.

For India’s exporters, the impact is immediate and visceral. Garment weavers in Tirupur, diamond cutters in Surat, pharmaceutical producers in Hyderabad, jewelry artisans, shri-mp exporters, and furniture makers all face duties as high as 50%. For small and medium-sized enterprises already grappling with inflation and supply chain disruptions, tariffs are not a mere inconvenience. They are existential.

The deeper injury is psychological: the erosion of trust. Trade thrives on stability. When tariffs appear and vanish with the mood of politics in Washington, the confidence required for long-term contracts and supply chain integration evaporates. Ironically, the very industries meant to help the U.S. diversify away from China are left dangling.

India’s Commerce Ministry denounced the tariff hikes as “selective and unfair,” while exporters scrambled to find alternative markets in Europe, the Gulf, and Southeast Asia.

History’s Lessons: From Smoot–Hawley to 2019

Tariff wars are not new. The Smoot-Hawley Tariff Act of 1930, designed to protect American farmers during the Great Depression, ended up triggering retaliatory tariffs from dozens of countries, exacerbating the global downturn. History records it as a cautionary tale of protectionism run amok.

India, too, has its recent scars. In 2019, the Trump administration stripped India of preferential access under the Generalized System of Preferences. At the time, the fallout was containable. But today, with supply chains more globalized and the stakes higher, the cost of a tariff war is magnified many times over.

The Fragile Architecture of Trust

For nearly two decades, Washington and New Delhi have painstakingly built a strategic partnership. Defense logistics pacts such as LEMOA (logistics), COMCASA (communications security), and BECA (geospatial intelligence) underpin cooperation in the Indo-Pacific.

That scaffolding was fragile to begin with, built not on destiny but on painstaking compromise and reassurance. By weaponizing tariffs, Washington risks pulling apart its own handiwork. If tariffs can appear overnight, what is to stop sudden export restrictions, sanctions, or technology bans tomorrow?

Today, with supply chains more globalized and the stakes higher, the cost of a tariff war is magnified many times over.

Every new uncertainty slows defense procurement, complicates technology transfer, and hardens negotiating positions. The collateral damage of tariffs could be most severe in the defense sector, the very backbone of U.S.-India convergence.

Beyond Bargaining Chips

Proponents of tariffs in Washington argue they are bargaining chips, meant to be lifted once concessions are won. But here lies the flaw: when the demand is not trade-related but political, alter your oil imports, shift your Russia policy, and the tariff ceases to be a chip. It becomes a chain. Even if lifted, the scar tissue of distrust remains.

India has its own levers: a billion-strong consumer base, geostrategic heft in the Indo-Pacific, and a defense budget increasingly attractive to U.S. contractors. But unpredictability pushes exporters and investors to hedge toward Europe, Southeast Asia, and the Gulf.

The Global Domino

The U.S. tariff surge is not confined to China and India; Europe faces new duties on steel and automobiles, Japan on electronics, and Canada and Mexico on agricultural goods. The message is clear: protectionism is back, not as a temporary tactic but as a governing philosophy.

The irony is striking. At a time when Washington seeks allies to counterbalance China, its tariff policies risk alienating those very partners. The Indo-Pacific coalition, once envisioned as a bulwark of democratic stability, now appears fractured by Washington’s own hand.

Smarter Tools, Wiser Choices

This rupture is not inevitable. If Washington’s goal is to pressure Russia, there are sharper tools: targeted financial sanctions, oil price caps, and coordinated diplomacy with energy-hungry allies. If the aim is market access, negotiations and trade agreements offer more durable solutions.

For India, the challenge is equally complex. Foreign policy autonomy is non-negotiable, but so is economic integration. New Delhi must double down on export diversification, cushion vulnerable industries, and accelerate reforms to attract defense and technology collaboration. Independence need not mean isolation, but partnership cannot mean subservience.

This conflict is not the trade deficit. It is the trust deficit. Tariffs don’t just tax goods; they tax goodwill.

Trust: The Real Deficit

At the heart of this conflict is not the trade deficit. It is the trust deficit. Tariffs don’t just tax goods; they tax goodwill. And goodwill, once eroded, is far harder to restore than any entry on a balance sheet.

For two democracies staking their futures on open seas, balanced power, and shared values, the erosion of trust may prove far more dangerous than any loss of market share.

In the rope game of tariffs, both Washington and New Delhi must ask themselves: Is the contest worth snapping the cord that binds them? For if it breaks, the damage will not stop at exporters and policymakers. It will seep into households and industries, shaking the very foundations of the Indo-Pacific order.