The semiconductor industry is now at the heart of a global tech revolution. From powering electric vehicles to enabling artificial intelligence and 5G, these tiny chips have become the giants of modern innovation. The numbers are staggering: a $600 billion industry today, racing toward a trillion-dollar future by 2030. Factories are rising, investments are pouring in, and nations are scrambling for control. This isn’t just growth—it’s a technological arms race. In the battle for tomorrow, semiconductors are the new gold, and the world is waking up to their unstoppable rise.

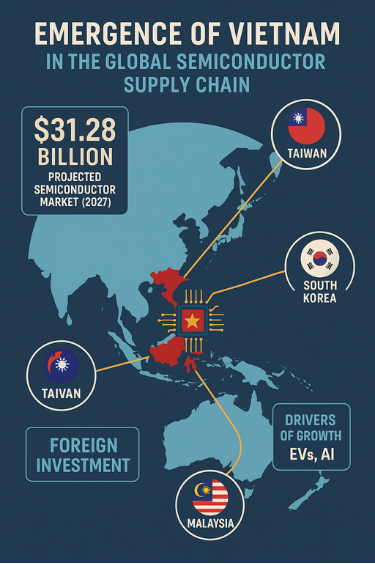

Vietnam is rapidly emerging as a significant player in the global semiconductor industry. This strategic rise is driven by robust government initiatives, increasing foreign direct investment (FDI), and the surging global demand for semiconductors across sectors such as electronics, electric vehicles (EVs), and artificial intelligence (AI). The country is making tangible progress in this high-tech domain, with its semiconductor market projected to reach a value of $31.28 billion by 2027, growing at a compound annual growth rate (CAGR) of 11.6% between 2023 and 2027. Vietnam faces tough competition from regional powers like Taiwan, Malaysia, and South Korea. All these states are well-established in the semiconductor supply chains. For example, Malaysia has been expanding its semiconductor manufacturing capacity significantly in packaging and testing services.

FDI and Industrial Expansion

As of 2024, Vietnam’s semiconductor industry has generated approximately $18.23 billion in revenue, primarily driven by FDI. Major global semiconductor companies—including Intel, Amkor Technology, and Hana Micron—have established substantial operations in the country. Amkor, for instance, is investing over $1.6 billion in an advanced packaging plant in Bac Ninh Province, which is expected to produce 3.6 billion units annually. Similarly, Hana Micron plans to invest around $930 million by 2026 to expand its chip packaging capabilities. This influx of investment underscores Vietnam’s attractiveness as a semiconductor hub, offering competitive labor costs, political stability, and geographic proximity to key Asian markets, including China.

Government Strategy and Vision

Vietnam’s government is playing a pivotal role in catalyzing this transformation. In September 2024, Prime Minister Pham Minh Chinh signed Decision No. 1018/QD-TTg, outlining the national Semiconductor Industry Development Strategy through 2030, with a vision extending to 2050. The strategy aims to establish a full-fledged semiconductor ecosystem, encompassing research, design, manufacturing, packaging, and testing. Short-term targets include:

Establishing at least 100 design companies by 2030,

Launching one semiconductor manufacturing plant,

Setting up ten packaging and testing facilities.

By 2050, the vision is to position Vietnam among the world’s leading semiconductor nations, with an expected annual industry revenue exceeding $100 billion.

Sectoral Drivers of Demand

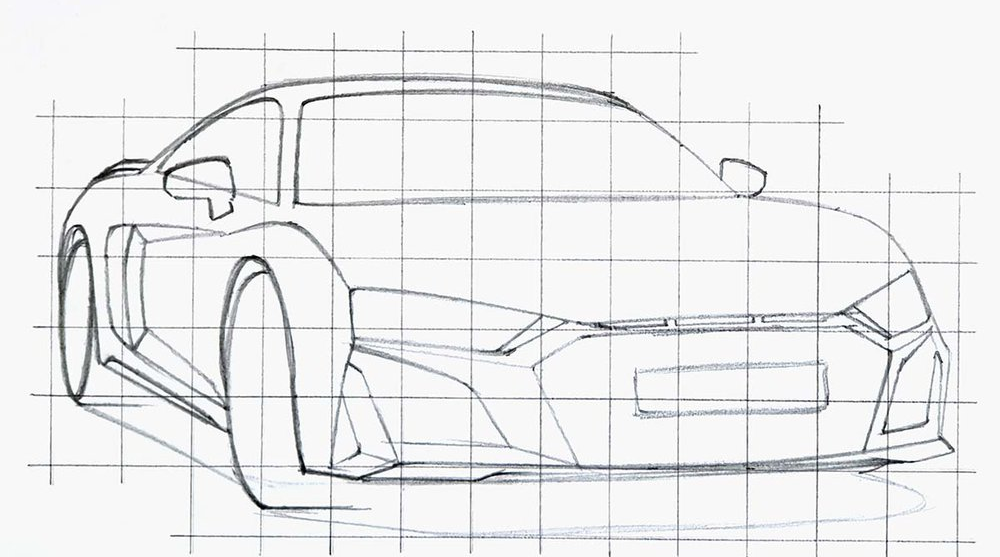

Electric Vehicles (EVs)

Vietnam’s expanding EV market is a major contributor to semiconductor demand. Domestic manufacturers such as VinFast, along with global players like Audi, Mercedes-Benz, and BYD, are accelerating their presence in the country. Globally, EV sales surged by 35% year-on-year, and by 2035, EVs are expected to account for 50% of all new car sales. Given that EVs rely heavily on advanced semiconductors for power management, connectivity, and automation, Vietnam’s EV boom is synergistically boosting its semiconductor industry.

Artificial Intelligence (AI)

Vietnam’s AI ecosystem is also evolving rapidly. FPT Corporation (originally the Corporation for Financing and Promoting Technology) recently announced a $200 million AI Factory, developed in collaboration with Nvidia. This initiative will strengthen Vietnam’s capabilities in both AI and semiconductor domains. Additionally, the growing demand for data processing, machine learning, and edge computing technologies reinforces Vietnam’s role in producing high-performance chips.

Challenges and Limitations

Despite its promising trajectory, Vietnam faces several significant challenges that could hinder the full realization of its semiconductor potential. Vietnam currently has around 6,000 semiconductor engineers, a number far below the industry’s growing demand. The Ministry of Information and Communications estimates an

annual requirement of 150,000 IT and digital engineers, yet the current education system is fulfilling only 40–50% of this need.[1] In response, the government has launched initiatives to train 50,000 semiconductor engineers by 2030, but the pace and scale of skill development must accelerate.

Infrastructure and Energy Resilience

High-precision semiconductor manufacturing demands stable infrastructure, particularly an uninterrupted power supply. Even brief outages can cause multi-million-dollar losses. While industrial parks such as the Saigon Hi-Tech Park are investing in independent energy sources, widespread energy resilience across the country remains a work in progress. Vietnam must also navigate stiff competition from established semiconductor players like Taiwan, South Korea, and Malaysia. For instance, Malaysia has been rapidly expanding its capabilities in packaging and testing services, consolidating its role in the regional supply chain. To remain competitive, Vietnam will need to offer unique advantages and continue diversifying its value proposition.

Conclusion

Vietnam’s semiconductor industry is poised for robust expansion and is a no accident. It is driven by government backing, strategic foreign partnerships, and increasing global demand. Its geographical proximity to China, competitive labour costs, and political stability provide key advantages. Vietnam’s rise in the global semiconductor landscape is the result of strategic vision, effective policymaking, and favorable geopolitical dynamics. The government has prioritized technological growth by incentivizing foreign investment, strengthening local capabilities, and navigating global supply chain realignments triggered by trade tensions. To solidify its position, Vietnam must rapidly upgrade national infrastructure, expand and modernize technical education and training, enhance energy reliability, and strategically differentiate itself from regional competitors. With consistent progress on these fronts, Vietnam is well on its way to becoming Asia’s next semiconductor powerhouse—a key player in reshaping the future of the global tech industry.

Saeeda Usmani is Research Assistant at China Pakistan Study Center CPSC, ISSI